New Prime Miniter Youth Business Loan 2023:-

Prime Miniter Youth Business Loan. PM Youth Business Loan 2023: Boosting Entrepreneurship and Economic Growth. Entrepreneurship has become a key driver of economic growth around the world, and Pakistan is no exception.

In an effort to support young entrepreneurs, the Government of Pakistan has launched the PM Youth Business Loan program.

- PM Youth Business Loan 2023 was launched by the Government of Pakistan.

- Aims to boost entrepreneurship and economic growth in Pakistan.

- Recognizes entrepreneurship as a key driver of economic growth globally.

- Targets young entrepreneurs to provide support and opportunities.

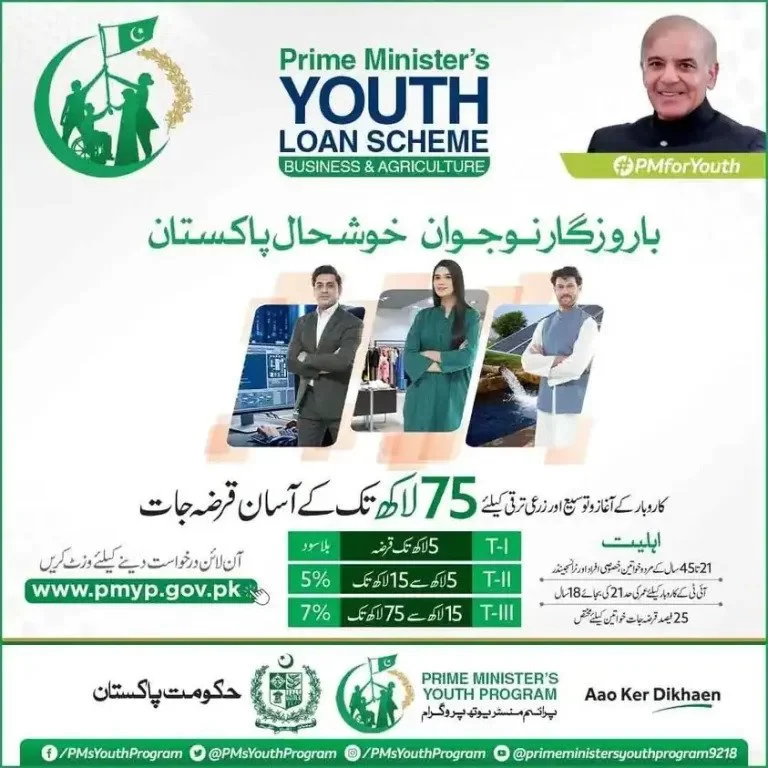

Detail of Prime Miniter Youth Business Loan:-

The PM Youth Business Loan program aims to provide low-interest loans to young entrepreneurs who want to start their businesses. Loans are available to people between the ages of 21 and 45, with a focus on youth, women, and underserved communities.

The program is administered by the National Bank of Pakistan (NBP) and First Women Bank Ltd. (FWBL), with the support of other partner banks. Loans are available for new and existing businesses in a variety of sectors, including agriculture, manufacturing, services, and commerce.

- PM Youth Business Loan program offers low-interest loans to young entrepreneurs aged 21-45, prioritizing youth, women, and underserved communities.

- National Bank of Pakistan (NBP) and First Women Bank Ltd. (FWBL) administer the program along with other partner banks.

- Loans are accessible for both new and existing businesses in sectors like agriculture, manufacturing, services, and commerce.

- Prime Miniter Youth Business Loan

Loan Amount and Repayment Terms:-

The PM Youth Business Loan program offers loans ranging from PKR 100,000 to PKR 5 million. The loan term is up to eight years, including a grace period of up to one year for principal payment. The interest rate is fixed at 6% per annum, with no collateral required for loans up to PKR 500,000.

- PM Youth Business Loan program provides loans from PKR 100,000 to PKR 5 million.

- Loan duration is up to eight years, including a grace period of up to one year for principal payment.

- The interest rate is a fixed 6% per annum.

- Loans up to PKR 500,000 do not require collateral.

Online Information:-

| How to Get More Inforamation | Click Here |

| For More Jobs Update | Click Here |

Application Process:-

The application process for the PM Youth Business Loan program is simple and easy to use. Applicants can apply online or visit the nearest NBP or FWBL branch. The following documents are required for the loan application. Prime Miniter Youth Business Loan

- National Identity Document (CNIC)

- Two recent passport size photographs

- Business plan

- Proof of business ownership

- Bank statement of the last six months (for existing companies)

- Any other documents required by the bank

Official Advertisement:-